Business loans that protect your cashflow

From $10K to $5M with monthly payments. Choose from SBA loans, working capital, term loans, or lines of credit—all without daily payments or predatory terms.

1000+ Businesses Served

$300M Deployed

20+ Lending Partners

500+ SMB Resources

Seven loan options, all with monthly payments

Compare timelines, terms, and best-fit options, then pick what matches your goals.

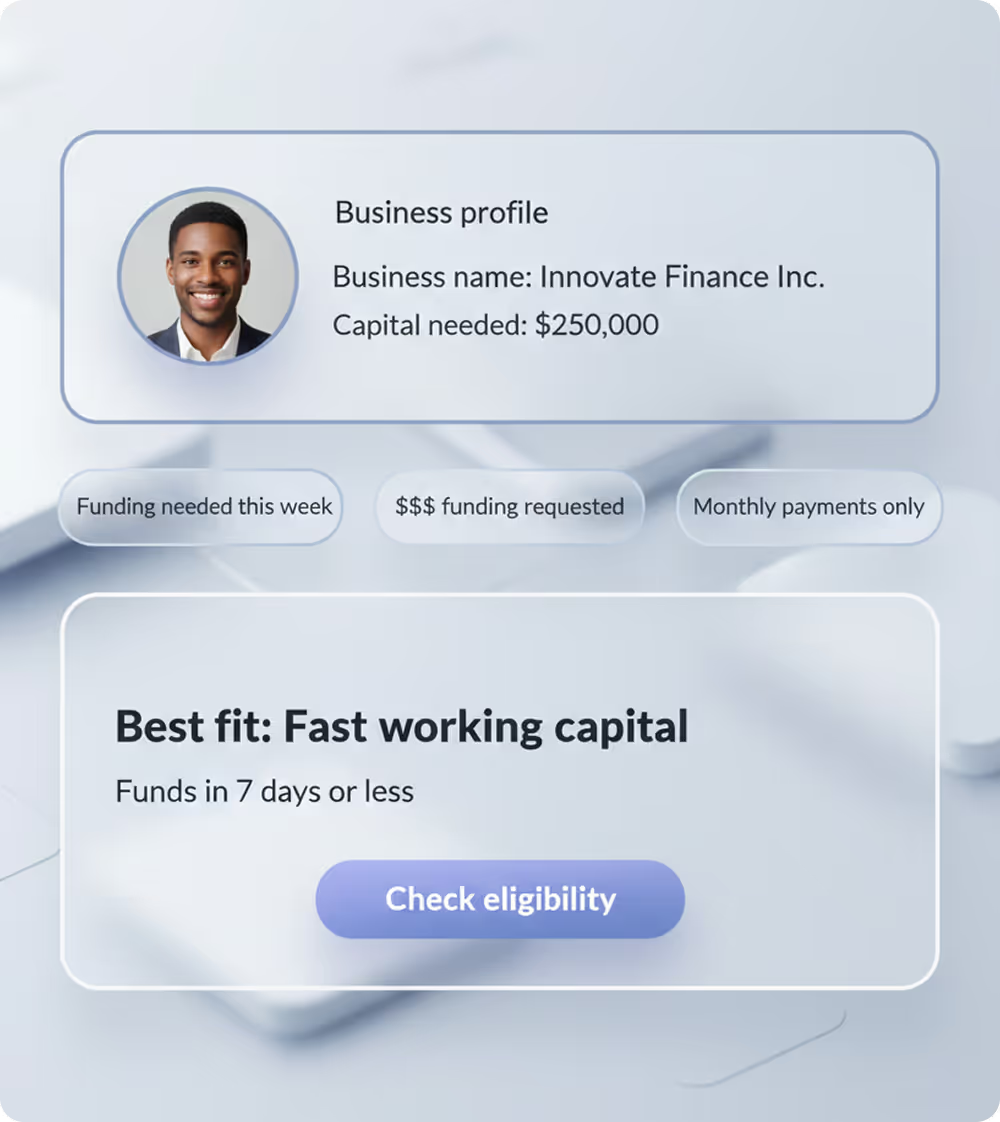

Fast Working Capital

Fast funding for businesses that need capital now. Our private loan can funds in as fast as 7 days.

- Term: 36 months, 10 year amo.

- Payments: Monthly

- Funding: As fast as 7 days

Growth Loans

Capital designed for expansion. Fund new locations, hiring, inventory, or scaling operations with confidence.

- Term: 2–14 years

- Payments: Monthly

- Funding: 2-3 weeks

Business Term Loans

Partner banks offer a short term business loan or long term loans, with payments and competitive rates.

- Term: 2–25 years

- Payments: Monthly

- Funding: 2-3 weeks

SBA Loans

The gold standard of small business loans with the lowest rates available. We simplify SBA loans and connect you with vetted lenders.

- Term: 7–25 years

- Payments: Monthly

- Funding: 3–6 weeks

Acquisition Financing

Purchase a business using SBA 7(a) or conventional acquisition financing. We guide your business acquisition loan through every step.

- Term: 7–25 years

- Payments: Monthly

- Funding: 3–6 weeks

Equipment Financing

Business equipment loans cover machinery, vehicles, or equipment. The equipment itself acts as collateral, helping secure better rates.

- Term: 2–7 years

- Payments: Monthly

- Funding: 2-3 weeks

Business Line of Credit

Draw what you need, repay, and draw again. Flexible access to capital for businesses that need an ongoing cash cushion.

- Term: Revolving

- Payments: Monthly

- Funding: 2-3 weeks

How do I know which loan is right for me?

Match your situation to the right loan type.

Higher rates but immediate access to capital.

Takes 3-6 weeks but worth the wait if you can plan ahead.

Which gets you better rates than unsecured loans.

Only pay interest on what you use.

We handle the complexity of acquisition underwriting.

Growth Loans - structured specifically for expansion costs with terms that match your growth timeline.

Business Term Loans - traditional structure, fixed payments, straightforward terms for working capital or any business use.

We'll walk through your situation and recommend the right fit.

Minimum eligibility requirements

Here's what you need to qualify for business loans

All loan types require

- 12 months in business

- 25k minimum annual revenue

- 640+ credit score

- 2 years since bankruptcy

SBA loans

- 640+ credit score

- Strong business financials

- Detailed business plan for startups

- No other sba defaults

Larger loans

- Stronger credit (680+ for $250K+)

- Higher revenue ($100K+ for $250K+)

- Longer time in business (24+ months for $500K+)

Don't meet these yet? Check our Founder Resources for grants, CDFIs, and specialty financing options that work for earlier-stage businesses.

Check eligibilityHow we deliver your loan

We fund some loans directly. We connect you to vetted partners for others. Here's how it works.

Our private loans

Fast Working Capital - funded with ChatBiz Finance in as fast as 7 days. We underwrite, approve, and fund these loans from our dedicated private fund partner.

Our partner loans

SBA, term loans, lines of credit, equipment, growth, and acquisition financing - provided by our carefully vetted lending partners. We handle your application, prepare your package, and connect you to the right lender or loan partner. You get access to better rates and terms than you’d find on your own through our partner lending solutions.

What you get either way

One application for all options. A dedicated lending expert who walks you through the process. No data selling to brokers or aggregators. Clear pricing and realistic timelines. Support from eligibility check through funding.

Led by banking professionals, not salespeople

1000+

$300M+

20+

NAGGL

What business owners are saying

They turned complex financial challenges into smooth solutions — and made the process enjoyable.

The team at ChatBiz Finance are knowledgeable and seasoned professionals, further strengthened by an entrepreneurial spirit. I highly recommend them.

ChatBiz helped me when I needed clarity and gave great advice throughout the process.

See which loan fits your business

Check your eligibility for up to $5M in business financing. No credit pull. No commitment

.png)